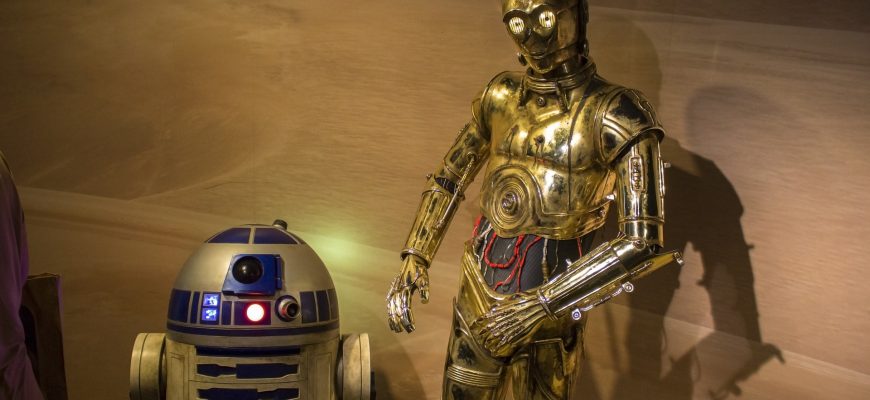

What do R2-D2, C-3PO and the DPA have in common?

While the first two are characters from the ever powerful Star Wars Films, the other stands for Data Protection Act.

The whole idea behind R2-D2 and C-3PO is that they were there to support the team.

… be it through translation of cultural differences, or to show what the enemy was getting up to.

The same can be said of the DPA (the Data Protection Act 1998).

It basically requires that organisations have a system in place to transfer records into a format which is easily understandable by those who need/want it.

Understandably, this is UK only legislation, although there are similar regulations worldwide (such as the Personal Data Protection and Breach Accountability Act 2014 in the US, or the Federal Privacy Act in Australia).

So, how does the DPA affect you?

As the Customer

When buying something on Finance or taking out Business Insurance there will be times when certain circumstances run out of our control and you need get to the bottom of where things went wrong.

Example 1

A company that I pay a monthly subscription too had messed up the type of payments they had been taking.

So, I asked for a Statement of Account.

This way I could understand what payments had been taken from my account, and whether or not I was due a refund.

Example 2

A client of mine’s suppliers had threatened to take legal action against her for failure to pay an outstanding balance.

I requested the following documents from the Data Controller:

- A Statement of Account – As in the example above

- A breakdown of the notes – e.g. details of exactly what has gone on on the account.

- A contract of service

In this instance, the so called creditor produced a Contract and documents which were aged and nothing to do with the current debt.

In essence, they did not have a current year contract, meaning there was nothing in their power they could do to enforce the contract in question.

But Consider This….

As a Customer you have a moral duty to maintain the upkeep of your Account. Within reason, of course.

Say you start ignoring your Suppliers/Creditors. This is being recorded against you and you are likely failing to adhere to whatever Terms and Conditions you had signed up to in the first place.

Most organisations request a £10 fee and up to two weeks notice to hand over everything they hold about you

… but it needs to be placed in a format you understand.

What do I mean by this?

If they use shorthand in their notes, as I’m sure many large companies do, they need to supply you with an explanation as to what each note does.

As a Business Owner

We all owe our customers a massive duty of care.

But what does this mean?

When you’re dealing with individuals who wish to use your consultancy services, for instance, or enlist your services to bring the greater good out off their business, you have to ensure that you have a record keeping facility that registers their personal details.

There may be instances in the future where your Customer asks you for a copy of any records you keep about them.

When going to Court

I’m not here to scaremonger Business Owners; large or small.

… But we have to have a dedicated system to help and assist others around us.

Our obligations as a customer are to pay our debts.

As a Business Owner, you must be able to produce a Statement of Account when requested by a customer.

… If you have nothing to show, when asked, you could be in trouble.

The Courts will ask for everything; phone calls, emails etc.

Advice

For further information on what the Data Protection Act can do for you, or the stark warnings that are necessary for your business records future, look at this link.

It’s an expense well worth looking into if you deal with many business customers on a regular basis

Or, if you need more personal advice, request a call with me and we can have a chat about your needs … whether you’re a customer being chased for debt or a business struggling with awkward customers.